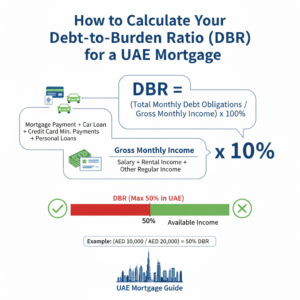

How to Calculate Your Debt-to-Burden Ratio (DBR) for a UAE Mortgage

In the UAE’s tightly regulated financial landscape, banks don’t just assess your willingness to repay a loan; they meticulously calculate your ability to do so. The single most important metric they use is the Debt-to-Burden Ratio (DBR). Mandated by the UAE Central Bank, this calculation is the ultimate gatekeeper for mortgage approvals. Understanding your DBR is not just beneficial—it is the essential first step toward a successful home loan application.

This definitive guide will explain what the DBR is, why it’s so important, and how to calculate it accurately, complete with detailed examples for different financial profiles.

What is the Debt-to-Burden Ratio (DBR) and Why Does It Matter?

The DBR is a simple yet powerful percentage. It represents how much of your gross monthly income is consumed by your total recurring monthly debt obligations.

The UAE Central Bank has set a strict limit: your DBR cannot exceed 50%.

This rule was implemented to protect both consumers and the banking system. It prevents individuals from becoming “over-leveraged” (taking on more debt than they can sustainably handle) and reduces the risk of loan defaults, which in turn promotes financial stability. If your calculated DBR is 50.1%, the bank’s system will automatically reject the application. There is no room for negotiation on this limit.

The DBR Formula and Its Components

The formula itself is straightforward:

DBR = (Total Monthly Debt Payments / Gross Monthly Income) x 100

The complexity lies in accurately identifying what counts as “income” and “debt.”

Defining Gross Monthly Income

This is your total income before any deductions like taxes (if applicable) or pension contributions. It must be regular and verifiable.

- For Salaried Employees: This is typically your basic salary plus any fixed allowances (housing, transport, etc.) as stated in your salary certificate.

- For Self-Employed Individuals: This is more complex. Banks will usually calculate an average monthly income based on the last 1-2 years of audited company profits. They will not simply take the full profit figure; they apply their own stress tests and may only consider a certain percentage.

- Other Income: Some banks may consider other regular income sources, such as rental income from other properties, but often only a portion (e.g., 75%) is included in the calculation. Bonuses and commissions are often averaged over a longer period (12-24 months) and may not be fully counted.

Defining Total Monthly Debt Payments

This includes all your existing and proposed monthly financial commitments.

- Proposed New Mortgage Payment: The estimated monthly installment for the home loan you are applying for.

- Personal Loans: The monthly payment for any personal loans.

- Car Loans: The monthly installment for any vehicle financing.

- Credit Cards: This is a critical and often misunderstood component. Banks do not look at your monthly statement amount. Instead, they typically calculate the liability as 5% of the total credit limit across all your cards. For example, if you have three credit cards with a total limit of AED 50,000, banks will add AED 2,500 to your monthly debt payments, even if you pay off the balance in full each month.

- Other Liabilities: This can include overdraft facilities, retail credit, or other financing plans.

DBR Calculation in Action: Detailed Scenarios

Let’s see how the DBR works for different applicants.

Scenario 1: Salaried Employee (Aisha)

- Gross Monthly Income: AED 40,000

- Existing Debts:

- Car Loan: AED 2,500 / month

- Total Credit Card Limit: AED 80,000 (Liability = 5% of 80k = AED 4,000)

- Proposed Monthly Mortgage Payment: AED 13,000

- Calculate Aisha’s Total Monthly Debt: AED 2,500 (Car) + AED 4,000 (Cards) + AED 13,000 (Mortgage) = AED 19,500

- Calculate Aisha’s DBR: (AED 19,500 / AED 40,000) x 100 = 48.75%

Result: Aisha’s DBR is below the 50% threshold. Her application can proceed to the next stage.

Scenario 2: Self-Employed Business Owner (Priya)

- Average Monthly Income (as calculated by the bank): AED 70,000

- Existing Debts:

- Business Loan Payment: AED 10,000 / month

- Personal Car Loan: AED 3,500 / month

- Total Credit Card Limit: AED 150,000 (Liability = 5% of 150k = AED 7,500)

- Proposed Monthly Mortgage Payment: AED 15,000

- Calculate Priya’s Total Monthly Debt: AED 10,000 (Business) + AED 3,500 (Car) + AED 7,500 (Cards) + AED 15,000 (Mortgage) = AED 36,000

- Calculate Priya’s DBR: (AED 36,000 / AED 70,000) x 100 = 51.4%

Result: Priya’s DBR is above the 50% limit. Her mortgage application would be rejected.

How to Improve Your DBR Before Applying

If your DBR is too high, like Priya’s, you have several options to improve it before you apply:

- Pay Down Existing Loans: The most effective strategy is to reduce your existing liabilities. Prioritize paying off smaller personal loans or car loans completely to eliminate those monthly payments.

- Reduce Your Credit Card Limits: This is a powerful and often overlooked tactic. If you have a high credit limit that you don’t use, contact your bank and request a reduction. Lowering your total limit from AED 150,000 to AED 80,000, for example, would reduce your monthly debt liability from AED 7,500 to AED 4,000 in the bank’s calculation, significantly improving your DBR.

- Consolidate Your Debts: In some cases, consolidating multiple high-interest debts into a single, lower-payment loan can reduce your total monthly outgoings.

- Increase Your Down Payment: By putting down a larger deposit, you reduce the loan amount you need to borrow, which in turn lowers your proposed monthly mortgage payment.

Understanding and managing your DBR is not just a box-ticking exercise; it is the key that unlocks your eligibility for a home loan in the UAE. Because different banks may treat certain allowances and income types differently, getting an accurate assessment can be complex.

Don’t leave your mortgage eligibility to chance. The experts at PRE APPROVAL Mortgage Consultant offer a free consultancy and eligibility check to provide you with a clear and accurate understanding of your DBR and borrowing power. Contact us today to begin a simple, transparent, and stress-free journey to homeownership.

Disclaimer

The information provided by PRE APPROVAL Mortgage Consultant on preapproval.ae (the “Site”), including articles, blog posts, calculators, and guides, is for general informational and educational purposes only.

All information on the Site is provided in good faith; however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, or completeness of any information on the Site. Financial regulations, interest rates, and government fees in the UAE are subject to change without notice.

The information provided does not constitute professional financial, legal, or investment advice. Any reliance you place on such information is therefore strictly at your own risk. You are solely responsible for any actions or decisions you take based on the content of the Site.

Before making any financial decisions, we strongly recommend that you consult with a qualified professional for personalized advice tailored to your specific situation. Please contact one of our expert mortgage consultants for a free consultation.